The self-employed growth rate within Sweden as of 2019 is 9.8%. [1] The relatively slower growth rate found in this country is due, in part, to the complexity of starting a business as well as the tax system.

While the growth may be slower in Sweden in comparison to other nations, gig work is not insubstantial as in 2017, it was estimated that 12% of the working population ages 16-65 were actively participating in the gig economy while twice that (24%) had at one point searched for employment opportunities through online platforms [2].

As seen worldwide, regulation impacts gig platforms as well as gig workers as it typically establishes the relationship between the two parties. In Sweden there has yet to be major decisions on the employment status of gig platform workers with regards to liability and obligation of the platform.

The only notable rulings by authorities was in 2018, when Swedish authorities declared that Uber drivers must acquire taxi licenses or taxiförarlegitimation to work for the gig platform [3].

To become a driver for the rideshare company, an individual must first acquire a taxi license which is typically a 2 month long process costing around 4,525kr [4]. Apart from this, the nation and Arbetsmiljöverket have yet to define the role gig platforms are to play in employment.

Who is interested in gig work in Sweden?

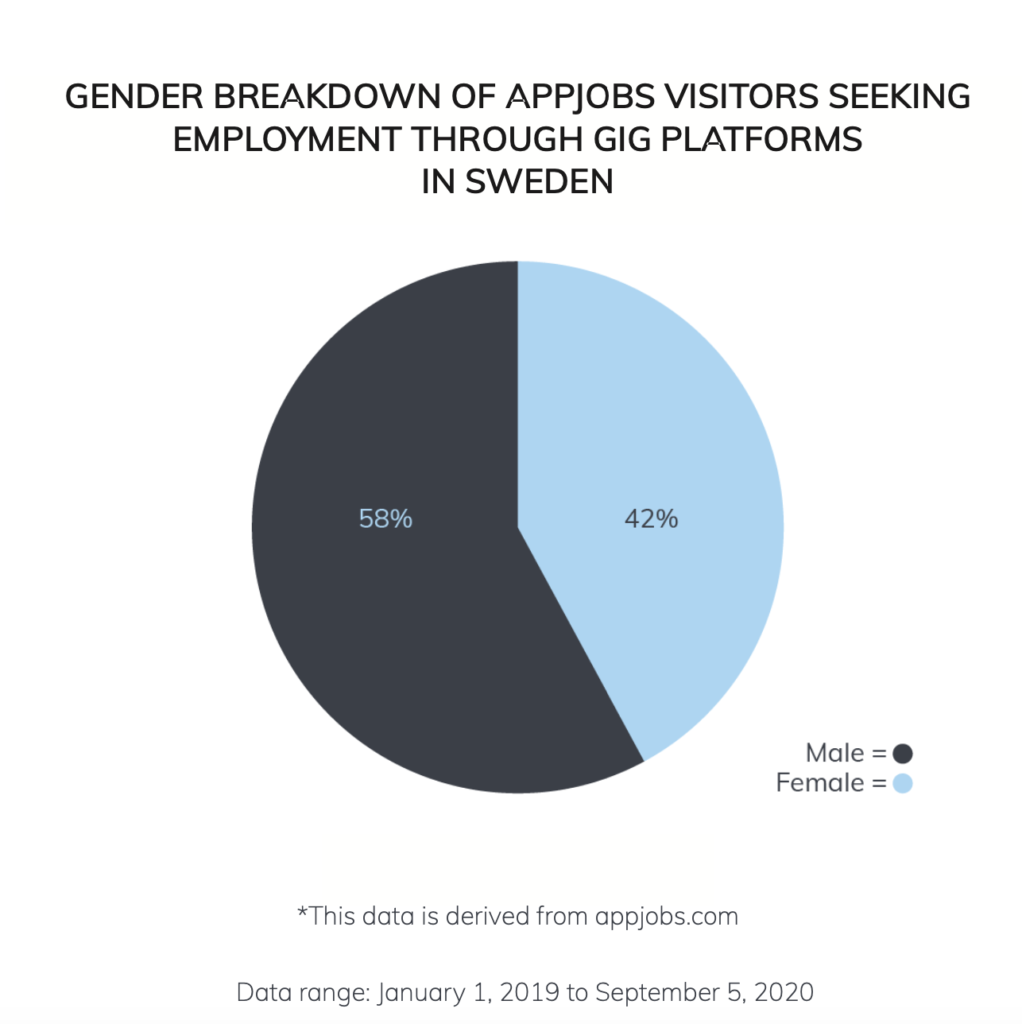

The gender and age interest distribution within the Swedish gig economy mirrors that of the worldwide breakdown. Males comprise over half of those seeking employment via gig platforms at 58% while women make up the remaining 42%.

Those falling between the ages of 25 and 34 make up the majority of the potential workforce at 44% with ages 35 to 44 following at 25%. The youngest generation of ages 18 to 24 make up 10% of those seeking gig work while the older generations ages 45 to 54 as well as 55 to 64 make up only 7% and 3% of the potential workforce respectively.

Tax Filing

With ambiguity in how to define an employee or an independent contractor, the Swedish legal system created criteria characterizing an employee. The determination or characteristics of an employee is as follows and should an individual not match these criteria then they are considered an independent contractor or freelancer:

“1) Is personally obligated to perform the work, whether it is stated in a (written or oral) contract or could be presumed by the parties to the contract;

2) Has himself or herself, personally or practically personally, performed the work;

3) is at the disposal (of the employer) continuously for work arising within the business of the employer;

4) the relationship between the parties is of a continuous, or of a ‘more lasting’ character;

5) is prohibited, under the contractual agreement or as a consequence of the conditions of work (time or capacity for other work), from undertaking similar work on behalf of someone else;

6), is, for the performance of the work, subject to the employer’s instruction or control in relation to how, where and when to carry out the work;

7) has to use the machinery, tools and materials provided by the other party (the employer);

8) is compensated for direct expenses, such as travel costs;

9) is remunerated for the work effort, at least partially, through a guaranteed salary;

10) is economically and socially, in a similar position to an employee.” [5]

The Status of Self- Employed

Those who work under the self-employed status pay the same income tax as those employed by a company. The progressive system of taxable income levels within Sweden is similar to that of most other countries within the European Union.

Independent contractors in Sweden must register for F-skatt (F-taxes) which indicate that the individual is an entrepreneur thus tax and social contribution payments are the responsibility of the freelancer.

Freelancers can open a limited company, at Bolagsverket, by a contribution of at least SEK 50,000 or SEK 500,000 for a public limited company. A limited company reduces liability risks as the company acts as a legally separate entity from the owner. Thus as a freelancer, personal finances are not at risk. The only caveat being as a freelancer, simplified expenses are legal as for limited companies expenses must be declared exactly.

Freelancers have a reduced rate owed in social contributions 28.97% opposed to the typical 32.5%. Also if an individual is an expert or highly skilled in their field they are able to apply expert tax concession resulting in a tax credit from 100% to 75%.

Independent contractors are also eligible for deductibles that are associated with business costs which include bills that are associated with home offices such as internet and electricity.

When filing as an independent contractor the municipality takes care of deducting the costs from income which includes the national and municipal tax. Although the rate varies on municipalities it typically is between 29-34%. Through the skatteverket, electronic filing can be done online usually once a year but twice is also an option [6].

General tax rates 2018

References

[1] OECD. Self employment rate. https://data.oecd.org/emp/self-employment-rate.htm (accessed September 7, 2020)

[2] University of Hertfordshire, Ipsos MORI, Foundation for European Progressive Studies (FEPS) and UNI‐Europa. Size of Sweden’s ‘Gig Economy’ revealed for the first time Around 700,000 crowd workers in Sweden. https://www.uniglobalunion.org/sites/default/files/files/news/swedens_digital_economy.pdf (accessed September 6, 2020)

[3] van de Wijngaard, Danny, Call For New Taxi Regulations After Several Convictions. November 14, 2018. . https://www.insidescandinavianbusiness.com/article.php?id=265 (accessed September 5, 2020)

[4] Uber. Get a taxi driver’s license in Sweden. https://www.uber.com/se/en/drive/requirements/get-a-license/ (accessed September 7, 2020)

[5] Anna Joelsson, Workers in the gig economy: employees or selfemployed? 2017. http://lup.lub.lu.se/luur/download?func=downloadFile&recordOId=8911988&fileOId=8911997 (accessed September 4, 2020)

[6] Moran. O. How to declare your income : freelance taxes in Sweden. Flime. https://blog.flime.com/working-for-yourself-in-sweden-with-flime#:~:text=Self%2Demployed%20individuals%20pay%20the,those%20employed%20by%20a%20company.&text=11%25%20county%20and%2020%25%20municipality,25%25%3A%20above%20675%2C700%20kronor (accessed September 7, 2020)