What numbers have told us so far

While “gigs” or side-jobs have always been a function of the economy, the rise in digital platforms transformed the nature of independent work, the use of widespread mobile devices allowed companies such as Uber Technologies Inc. or TaskRabbit Inc. (acquired by the IKEA Group Corp in 2017) to reach unprecedented pools of both workers and customers.

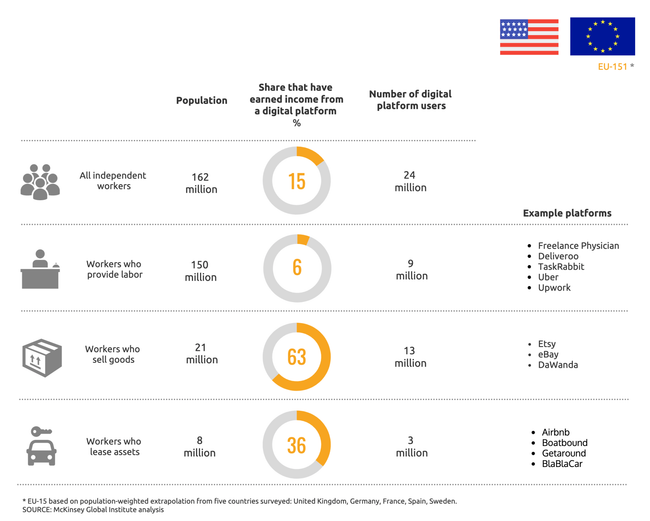

This online marketplace is estimated to be used by 15% of gig workers [2]. Across the world, there are already 50 million people registered on digital platforms offering gig work [2].

The 2008-2009 financial crisis saw the term “gig economy” rise to the mainstream[1], with the advent of large groups of the working-age population taking on work characterized by a high degree of autonomy, payment by task, assignment, or sales, and a short-term relationship between worker and client.[2]

Assignment-based work is widespread in many sectors of the economy: research conducted by the Boston Consulting Group in 11 markets indicated that this sort of work was most common in the IT sector with the finance and insurance industry up next and followed by agriculture, mining and manufacturing and logistics. What this points to is that the gig economy embraces fields that require both higher and lower educational qualifications.[5]

Digital platforms have transformed the gig economy. Between 25 and 40 percent of people who earn income by leasing out their assets use digital platforms such as Airbnb, HomeAway or VRBO. Platforms for offering services such as Uber, TaskRabbit and Upwork were used by 6% of independent earners in the US and the EU-15[6] compared to the aforementioned 25 – 40%.

One example of a digital platform transforming the nature of work and the driving sector is Uber. Since its inception in 2009, the gig-economy darling Uber has not only captured market share but also increased the size of the market, and essentially become the face of the successful disruptive gig economy business model.

In year-end 2018, 95 million people used the Uber app on a monthly basis, with a global net revenue that amounted to 11.3 billion U.S. dollars. Uber boasts 69% of the ridesharing market (where consumers who need a ride can instantly request one using their smartphones or GPS satellites – a cheaper version of a taxi service) [7].

Asset leasing is yet another sector in which the digital gig economy has taken a strong foothold. Founded in 2008, AirBnB is a digital marketplace that connects people who are looking for a place to stay with people who want to rent out their homes i.e. their assets. With listings in over 191 countries, guests are able to book homes that usually cost less than a typical hotel room would cost. Currently privately held, the company is estimated to have generated $93 million in profit on $2.6 billion in revenue in 2017, with exact figures not provided in 2018.

Considering driving and asset leasing as two of the most promising categories in the gig economy, and based on millions of data points generated through AppJobs Institute, both leading industries were carefully analysed in order to raise data and insights to show their prominence in the industry when it comes to performance on growth in terms of sign ups.

According to internal data reflected in the graphic above with interactive capabilities, it is still implied that the driving industry is growing at higher rates than asset leasing. There are four companies growing between 14% and 10% in terms of monthly sign ups. With that seen, AppJobs Institute infers there is still room for growth inside the driving industry, which may potentially revert current losses on driving companies and get them on track for break-even in the future.

Moreover, the growth registered helps to minimize arguments from economists and financial analysts who see the driving industry in marginal decline in terms of growth. When it comes to partners operating within asset leasing industry (rental category inside AppJobs database), the monthly registration of users is growing between 6% and 7% when the two leading players are considered.

Some statements can be observed given the exclusive data brought by AppJobs Institute. First, this demonstrates that within the sphere of digital platforms and the gig economy, the driving industry could be poised for further growth in terms of the pool of customers, available workers and capillarity more so than asset leasing. On the other hand, it might show the driving industry as the one closer to maturity level and well established in the gig economy, while other sectors such as asset leasing may have their momentum in the future with a more robust growth.

Despite nuanced differences in reports by established consulting companies and up-to-date, on-the-ground data from companies working directly in the field, such as AppJobs Institute, one thing remains clear: the digital gig economy is poised to continue growing.

Whether it is leasing out assets or driving, all categories show growth and continued potential. Digital platforms remain an integral component of the gig economy as we know it today; they not only ease the connection between supplier and consumer but also are important sources of current data.

The growth in registrations on AppJobs, we believe, also reflects a changing attitude by workers to the gig economy which is also supported by research conducted by the McKinsey Global Institute. As many as one in six people in traditional jobs would like to become “primary independent earners” where independent work is their primary source of income.

This group, in absolute numbers, adds up to more than 42 million people in the US and EU-15 combined [2]. This is supported by data from AppJobs Institute: across a variety of digital gig economy sectors, there has been a monthly increase in registrations.

References

[1] https://www.forbes.com/sites/johnfrazer1/2019/02/15/how-the-gig-economy-is-reshaping-careers-for-the-next-generation/#75a4f03049ad [2]https://www.mckinsey.com/~/media/McKinsey/Featured%20Insights/Employment%20and%20Growth/Independent%20work%20Choice%20necessity%20and%20the%20gig%20economy/Independent-Work-Choice-necessity-and-the-gig-economy-Full-report.ashx [3]https://www.bloomberg.com/news/articles/2018-07-23/maybe-the-gig-economy-never-was-what-it-used-to-be-quicktake [4] https://financialobserver.eu/poland/the-gig-economy-is-becoming-increasingly-global/

[5] https://financialobserver.eu/poland/the-gig-economy-is-becoming-increasingly-global/ [6]https://www.mckinsey.com/~/media/McKinsey/Featured%20Insights/Employment%20and%20Growth/Independent%20work%20Choice%20necessity%20and%20the%20gig%20economy/Independent-Work-Choice-necessity-and-the-gig-economy-Full-report.ashx [7] https://www.statista.com/statistics/550635/uber-global-net-revenue/

[8] https://www.bloomberg.com/news/articles/2019-01-15/airbnb-says-it-made-a-profit-again-in-2018-as-ipo-looms-large