The last decade highlighted the emergence of the gig economy model. Companies such as AirBnB, by making the networking and communication easier between renters and those seeking a short-term stay, allowed each side to fill some of its needs, either as an additional source of income or accommodation in places and prices different from a hotel.

An econometric study, focusing on the impact of AirBnB on the housing markets in the USA, identified a positive correlation between the platform’s listings in a city and the city’s housing prices (Barron, K., Kung E. and Proserpio D. 2020). The results of another study, focusing on Boston, reached similar conclusions and highlighted a correlation between inflatory prices in the housing sector and expanded AirBnB activity (Horn and Merante 2017).

Beyond the impact of the gig economy on people’s lives, one can observe the influence of the younger generations over the emergence of this kind of platforms. A survey conducted by AirBnB on people between the ages of 18-35, living in China, the United Kingdom and USA, highlighted the significance that “millennials” play in the growth of AirBnB (Airbnb 2016).

Having those in mind, this article is going to discuss the impact of applications and platforms working in the private home/space rental sector – like AirBnB – on the lives of people under the age of forty and on the rental markets. In this attempt, the article is going to make use of internal data by the AppJobs Institute and data gathered by external sources. The article is focused on a local scale, i.e. it is focused on cities.

The cities selected are Madrid and Prague. This selection was based on two reasons: i) Emerging involvement in the private room/space renting sector: Both of these European capitals have faced an increase in the activities involved in the sector of private room/space renting over the last few years, allowing a better evaluation of the role that platforms of this type have in a city and ii) Differences in city structure and demography: Madrid and Prague differ in size and population, giving the chance to discuss the impact of these apps in different contexts.

Madrid is a large city with high rates of involvement in the gig economy. According to internal data of the AppJobs Institute, Madrid is among the top 20 cities on monthly growth rate of gig workers (AppJobs Institute n.d.).

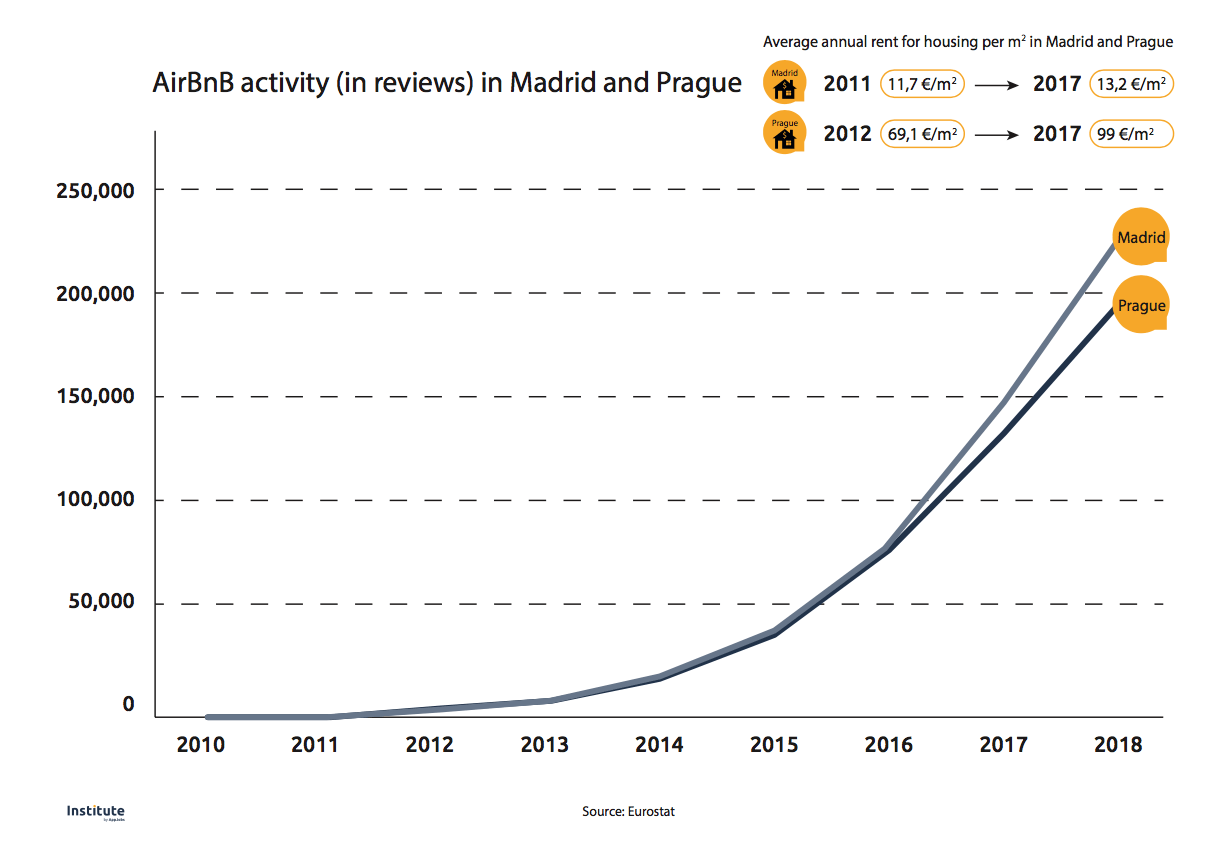

In this context, many of these workers get occupied in the sector of private home/space renting. This higher involvement in the sector started to launch after 2015. Data from AirBnB support this argument, where the activity in the houses and apartments rented through AirBnB, measured by the reviews these places received, skyrocketed after 2015. This trend highlights the degree of attractiveness for someone to get involved in the sector of space renting that the gig economy has to offer.

In parallel, the population in the city aged 20-44 decreased by 187.000 during the period of 2010-2018. As a percentage of the total population of the city, this age group covers the 34,2% for 2018, even though this percentage was 39,3% in 2010.

Madrid’s housing sector remained stable under the period 2010-2018. According to statistics by Eurostat, the number of private households in the city increased marginally. Furthermore, the average annual rent for housing per m2 rose slightly over the years.

Prague, on the other hand, is a case with different characteristics than that of Madrid. Statistics on the city’s population in the group age 20-44 do not demonstrate any large changes over the last couple of years, either it is in total numbers or as a percentage of the total population.

Involvement in the space renting sector of the gig economy in Prague has gained popularity in the last couple of years. The activity of AirBnB increased in the city, especially after 2016. In total numbers, the activity in the platform is comparable to the case of Madrid, even though it is a smaller city. This might be the explanation for figures on the city’s housing sector.

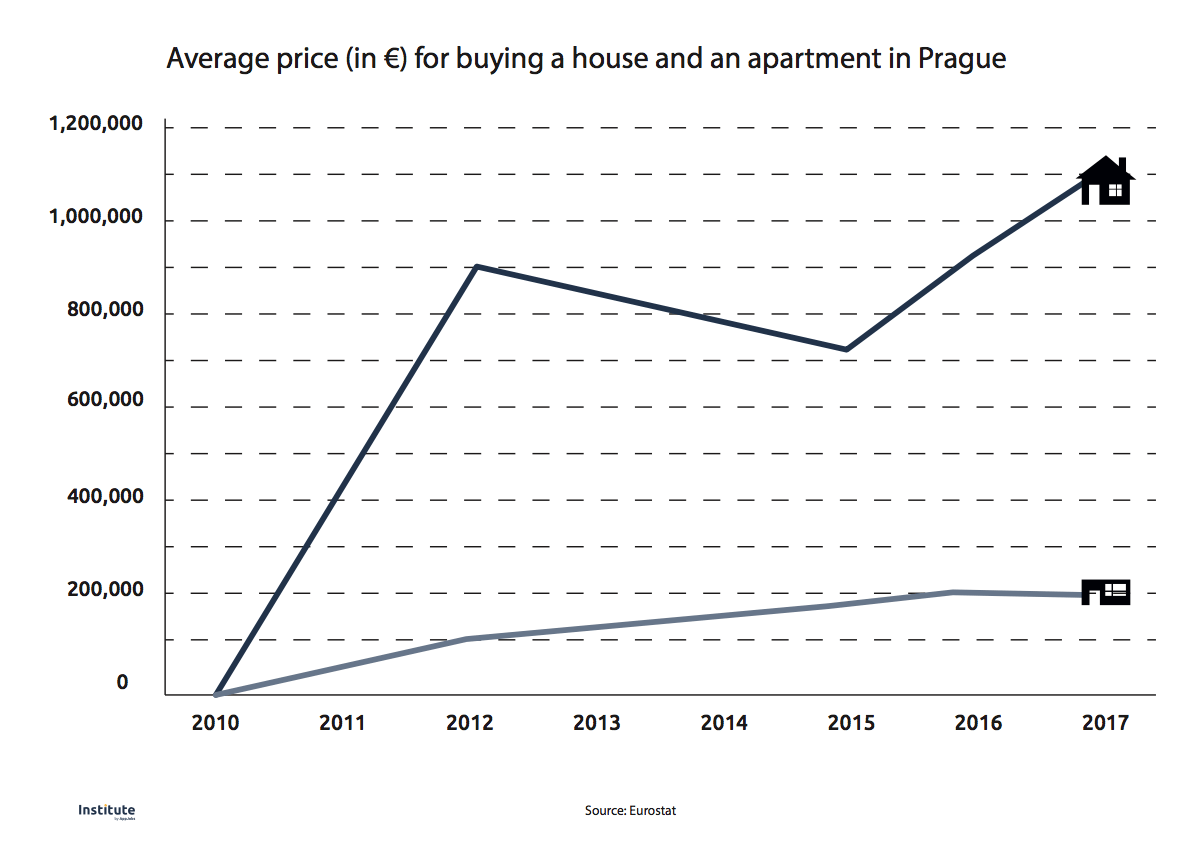

The housing sector of Prague exhibits significant changes occurring over the years. Statistics on the average price for buying a house, buying an apartment and the average annual rent for housing per m2 illustrate major inflationary rates over the years. More specifically, prices in all these three categories highly increased over the years.

In summary, both of the selected cases illustrate interesting insights on the cities’ housing markets and engagement with the gig economy. Statistics present stable figures in the housing sector of Madrid, even though the activity of gig workers in the sector gained a boost after 2015. In the case of Prague, however, the prices in the housing sector increased simultaneously with the rise in involvement in the private housing/space renting sector.

References

Airbnb (2016), ‘Airbnb and the rise of Millennial travel’, November 2016 Report. AppJobs Institute (n.d.), ‘In which cities is the gig economy growing the fastest’, AppJobs Institute. Available at: https://www.institute.appjobs.com/in-which-cities-is-the-gig-economy-growing-the-fastest (Accessed: 03 February 2020) Barron, K., Kung E. and Proserpio D. (2020), ‘The Effect of Home-Sharing on House Prices and Rents: Evidence from Airbnb’, Working Paper.Horn, K. and Merante, M., (2017), ‘Is home sharing driving up rents? Evidence from Airbnb in Boston’, Journal of Housing Economics, 38, issue C, p. 14-24.